Table of Contents

- 미국 ETF 추천! QQQ (Invesco QQQ Trust Series1) 완벽정리! - 정보플러스

- QQQ: Almost Time For A Breather (NASDAQ:QQQ) | Seeking Alpha

- qqq — Postimages

- Choosing Between QQQ and VOO ETFs: Tech vs. Diversification - Coin ...

- qqqq - YouTube

- QQQ - YouTube

- QQQ Makes Invesco No Money, So It Created a Family of Baby ‘Qs’ - Bloomberg

- qqq_qq_q on Spotify

- Qqq Vectors & Illustrations for Free Download | Freepik

- The Top 10 PowerShares QQQ Holdings | Nasdaq

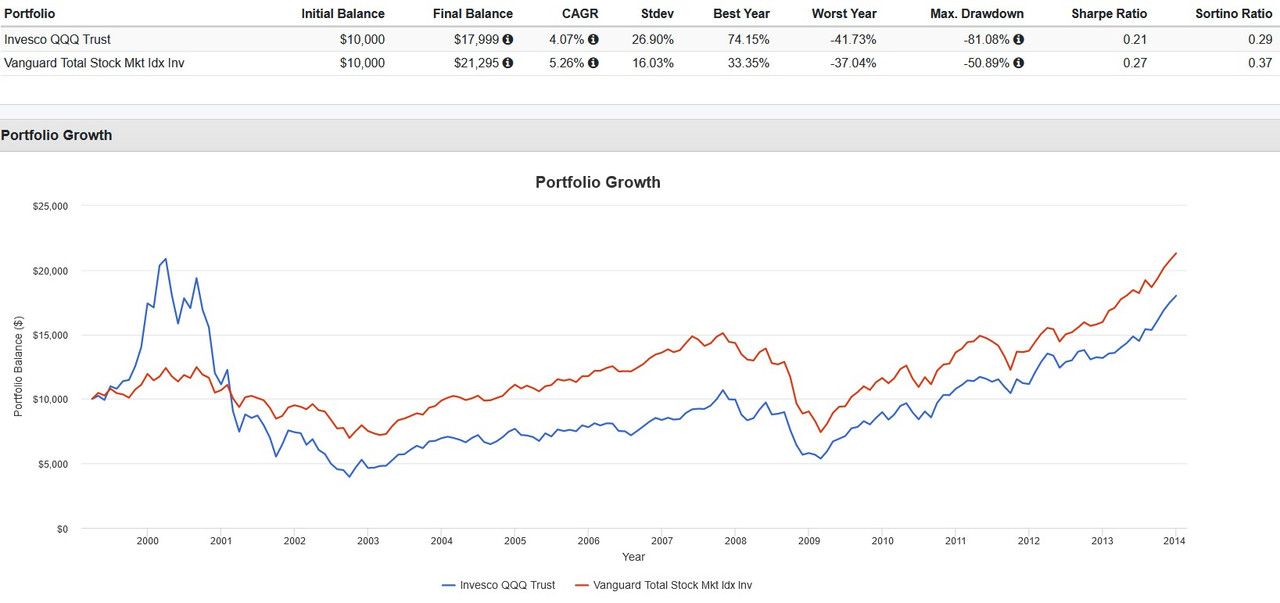

Historical Performance

Volatility

Factors Influencing Performance

Several factors can influence the performance of the Invesco QQQ ETF, including: Technology sector performance: As the ETF is heavily weighted towards tech stocks, its performance is closely tied to the overall performance of the technology sector. Economic conditions: Economic downturns or recessions can negatively impact the ETF's performance, as investors become more risk-averse and sell off their holdings. Interest rates: Changes in interest rates can also impact the ETF's performance, as higher rates can make borrowing more expensive and reduce consumer spending. Global events: Global events such as trade wars, political instability, and natural disasters can all impact the ETF's performance.

Investment Strategy

For investors looking to add the Invesco QQQ ETF to their portfolio, there are several strategies to consider: Long-term investing: The ETF is suitable for long-term investors who are looking to ride out market fluctuations and benefit from the growth of the tech sector. Dollar-cost averaging: Investing a fixed amount of money at regular intervals can help reduce the impact of market volatility and timing risks. Diversification: The ETF can be used as part of a diversified portfolio to provide exposure to the tech sector and reduce overall portfolio risk. In conclusion, the Invesco QQQ ETF is a popular and widely traded ETF that provides investors with exposure to the 100 largest and most actively traded non-financial stocks listed on the Nasdaq stock market. With its strong historical performance, low expense ratio, and diversified portfolio, the ETF is an attractive option for investors looking to gain exposure to the tech sector. However, as with any investment, it's essential to carefully consider the factors that influence its performance and develop a well-thought-out investment strategy.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors should consult with a financial advisor before making any investment decisions.